Contact-Center Outsourcing5-minute read

How Improving Customer Service in Finance Can Benefit Your Business

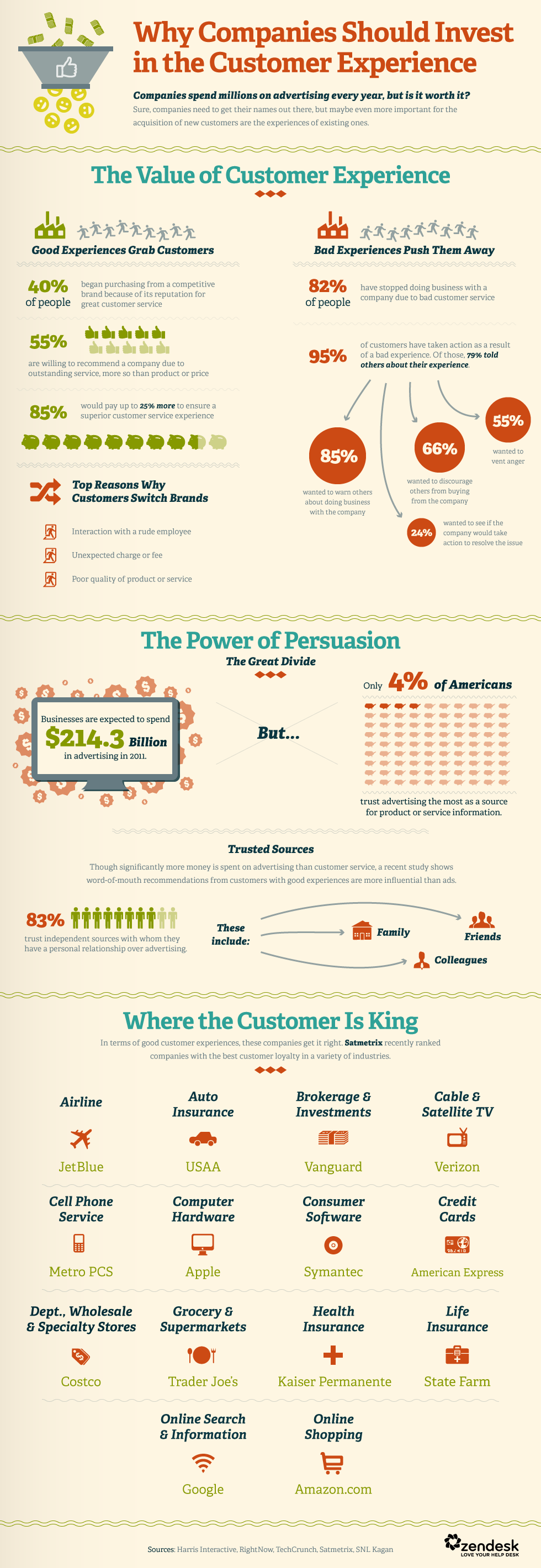

Businesses today are focusing more on offering a great customer experience (CX) than ever before. And with good reason: According to Bain & Company, companies that excel at offering a great customer experience can expect to grow their revenues as much as 8% above their market.

“Companies that excel at offering a great customer experience can expect to grow their revenues as much as 8% above their market.” Share on X

Yet this focus on the customer experience too often includes only front-line departments like sales and marketing, ignoring the importance of offering great customer service in finance, payments and invoicing. And that means that customers can be confronted with a subpar experience during what’s arguably the most critical moment—when they actually hand over their hard-earned cash.

Even businesses that have worked hard to provide the best possible customer experience when it comes to creating a great marketing message or managing customer complaints can struggle with translating that standard to financial transactions. And that can be a real problem, as there are few aspects of a business that customers are more sensitive toward than financial transactions.

Source: https://www.business2community.com/customer-experience/customer-experience-important-advertising-infographic-0726258#Xi4uqsqvtb3qKjhK.32.

As The Financial Brand’s Amber Sullivan notes in a report on customer service in finance, consumers cite “basic customer service and security concerns” as the two most important ways that financial institutions can retain their business. She also mentions a study by March Networks that found a fifth of consumers say they’ve actually switched banks after a “negative customer service experience.”

And while it’s true that these findings apply to financial institutions, it’s also safe to assume that customers harbor similar feelings about payments and financial transactions with any company with whom they do business. All businesses offer some sort of financial apparatus as part of their operating model, after all, and customers are increasingly expecting those transactions to be of high quality.

A company’s finance department, however, rarely shares in the CX innovations being made by other departments, likely because payments and finance have little to no role in actually winning new customers. But it’s a department that does have an enormous role in something that may be even more important, from a revenue standpoint: Keeping customers satisfied and loyal.

The good news is there’s ample opportunity for businesses to improve the level of customer service in finance and payments. Furthermore, taking the initiative to do so not only helps to ensure customer satisfaction, but can also help companies achieve an impressive list of additional benefits, too.

5 Ways Improving Customer Service in Finance & Payments Can Benefit Your Business

It is essential to emphasize to customers that each transaction they make with your business is done with the highest level of safety and security.

Source: www.shutterstock.com.

1. Ensuring Safety and Security. As Sullivan points out, the security of customers’ financial information is usually top of mind when they’re actually making their purchases. And so, it’s essential to emphasize to them that any transactions they make with your business are done with the highest level of attention to the safety and security of their most sensitive data.

Even beyond working toward improving your company’s CX, achieving greater data security is an important operational goal for any business, period. And there are proven methods for doing so, too, including not just the use of encrypted data, but also vetting the agents who deal with sensitive info and investing in the type of hardened infrastructure that’s difficult to hack.

Related read: How to Improve Customer Security with Virtual, On-demand Customer Care

Paying close attention to the customer experience can help you spot an issues and come up with a solutions.

www.shutterstock.com.

2. Taking a More Proactive Approach to Customer Satisfaction. Paying closer attention to the financial information of your customers can often clue you in to potential satisfaction issues about which you might not otherwise be aware. For instance, customers with a history of late payments may not simply be negligent, but actually signaling dissatisfaction with the products or services you’re providing.

Keeping a closer eye on the customer experience from a financial perspective can help you spot and correct potential issues before they become bigger, more company-wide problems. And that, in turn, can lead to greater levels of customer satisfaction and loyalty, which are critical drivers for future growth and success.

Related read: Why Customer Satisfaction & Loyalty Are Critical to Your Long-term Success

Customers expect a high level of personalization from companies.

Source: www.shutterstock.com.

3. Extending Your Efforts at Personalization. A high level of personalization has become standard thanks to digital leaders like Google and Facebook, which, according to a McKinsey & Company report, have raised consumer expectations for personalization in other companies, too.

On top of that, Accenture Strategy’s 2017 Global Consumer Pulse Research reveals that 33% of all customers who abandoned an existing relationship with a business “did so because personalization was lacking.” In short, more and more data support the idea that customers truly value personalization—all the more reason to extend your efforts at a customized experience into financial transactions.

And there’s a real need for this, as most financial departments don’t prioritize personalized care to the same extent as, say, sales and marketing departments. The result is that everyone tends to be treated the same—say, everyone is subject to the same payment terms, even if they’re long-time customers. And that’s ignoring a golden opportunity to reward loyal shoppers and nurture higher levels of satisfaction.

Related read: How to Leverage Technology to Achieve Personalized Service

Marketing data and consumer information can help improve the overall customer experience efficiency.

Source: www.shutterstock.com.

4. Improving Operational Alignment and Efficiency. Offering a customized CX across every department also can help you sync your larger operational goals and improve overall efficiency. Working toward personalization means streamlining consumer information. That includes marketing data and payment info, which can help you align your personnel toward the same goal on a company-wide basis.

This extension of an emphasis on the customer experience into your financial department can help to ensure certain key performance indicators (KPIs) are shared across a broader base of team members. And working more effectively toward shared goals isn’t just a great way to improve efficiency: It also helps facilitate better intradepartmental communications, and is generally good for employee morale, too.

Related read: How to Improve Operational Performance

Consider various touchpoints associated with your finance department and the overall customer experience.

Source: www.shutterstock.com.

5. Achieving True Customer Empathy. Finally, it’s worth considering how important the various touchpoints associated with your finance department are to the overall customer experience. By streamlining these important areas, you’re making it easier and more satisfying to do business with your company.

And this is the type of improvement that customers notice — or, to put it more accurately, it’s the sort of thing they notice a lack of. By providing a single, easy-to-access source for all billing inquiries, or creating a payment interface that securely preserves their payment data and history, you’re showing that you care about them, and are making an active effort to avoid wasting their time.

Related read: How to Ensure Empathetic Customer Care

Need Help Improving Your Customer Service in Finance and Payments?

If these benefits sound appealing, but you’re not sure just how you can go about putting them in place, worry not—we’re here to help.

With more than 20 years of experience helping companies across a wide variety of industries improve customer service in finance (as well as every other department), Working Solutions has the experience and expertise to help you achieve the kind of quality CX that inspires true customer loyalty.

Discover how we can help you reach new heights in customer service.

Contact us today to schedule your complimentary consultation with a Working Solutions customer service expert.

Let's connect.

This Might Interest You...

This website uses cookies to personalize and improve your experience. Continue browsing our site if you agree to our Cookie Policy or feel free to Manage Cookies yourself.